Annual Shareholders Meeting

Annual Shareholders' Meeting Reports in PDF format:Collegedale Credit Union presents to you our

1st Place Absolutely Incredible Kid Award Winner! - Eunseol

Photo (left to right): Principal, Callie Stewart; CCU CEO, Joy Traxler; Student, Eunseol; Mother, Hwayeon, and Teacher, Vandana Taneja

Photo (left to right): CCU CEO, Joy Traxler handing Eunseol her award with Teacher, Vandana Taneja

"I have an Absolutely Incredible student in my English as a New Language class since Kindergarten. She is now in third grade, her name is Eunseol and I would like to nominate her for this award. She was born in South Korea and started here in Kindergarten at Apison Elementary School. She was very quiet and shy when she was a newcomer to USA, but she was always a good listener and cared about school. Eunseol is a role model student. She is very respectful, polite, motivated, focused and helpful to me and also towards other students.

She is also a good big sister. She helps her younger brother walk to his hallway every morning after arriving to school. She participates in after school tutoring to improve her reading skills. She is now one of my highest readers. This year she has started asking good critical thinking questions and is able to make inferences and explain her thought process. She recently researched and made a Google slideshow with 16 slides about South Korea to demonstrate pride in her country and her culture. Last year, she did an awesome presentation about South Korea at the Culture Fest with a poster board. She taught Orgami to other students that stopped at her booth.

Eunseol is very thoughtful, kind, creative and artistic. She has always remembered to make me hand drawn cards with Orgami and personalized messages for all holidays. She has made the most beautiful cards and decorated them with stickers, sparkles and her own illustrations. I hope you will pick her as an Absolutely Incredible Kid."

Congratulations, Eunseol! Keep up the great work!

Collegedale Credit Union presents to you our 2nd Place Absolutely Incredible Kid Award Winner! - Ethan

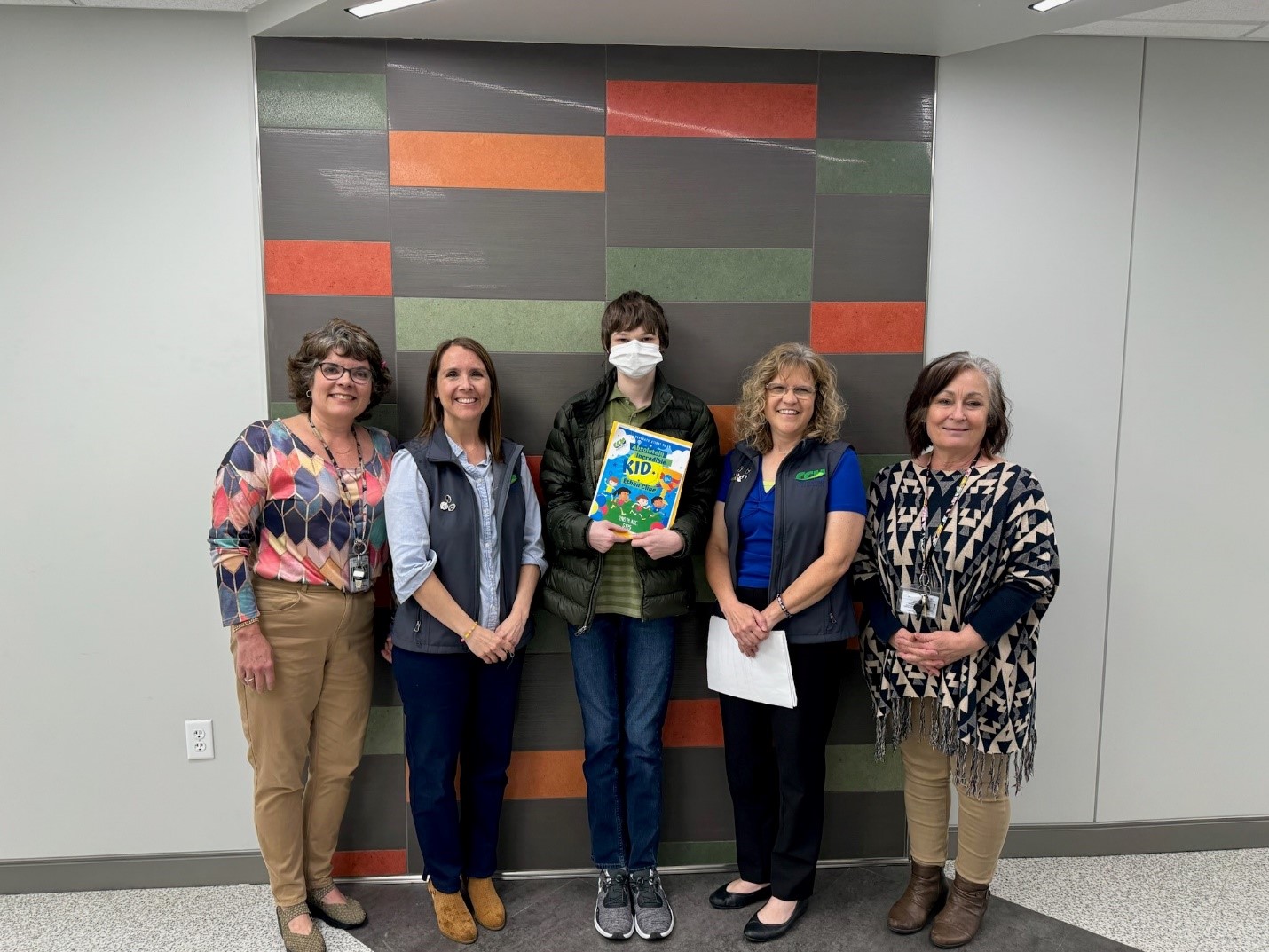

And here is what Mrs. Terry had to say about him!"Ethan is a unique individual with many talents beyond his years. ‘The Technical Wizard’ is what he is known as. Students and staff alike [have] needed his magical touch to fix, explain and solve many technical issues. He excels at learning new programs to share with his peers. Our class recently received a 3-D printer which Ethan quickly taught himself and created a variety of objects to share with classmates. I full expect Ethan to be part of the technology team to send men to Mars."

Photo (left to right): Teacher, Chalea Terry; CCU Asst Mgr, Kim Abernathy; Student, Ethan; CCU CEO, Joy Traxler; Teacher, Laura Long

Photo (left to right): Student, Ethan; Teacher, Chalea Terry

Collegedale Credit Union presents to you our 3rd Place Absolutely Incredible Kid Award Winner! - Dane

And here is what Sgt. Rominger had to say about him!"Dane is the prime example of how we should all treat one another. He is always taking the extra step to help his classmates, pays special attention to others in need, and always has a smile on his face. As a Kindergartener, he is wise and compassionate beyond his years. He is a blessing to everyone he has contact with and always puts others first. I would love to see him be honored for being the example we all should be to those around us. He blesses me and inspires me to want to be a better person every day."

Congratulations, Dane! Keep inspiring and blessing those who know you!

Photo (left to right): Dad, Andrew; Sister, Nora; Mom, Danielle; Sister, Millie; Student, Dane; CCU CEO, Joy Traxler

Truly Honorable Mentions:

Here is what Mrs. Schepers had to say about Aria!"Aria is very thoughtful towards others. She recognizes others' feelings and attempts to help them. Aria is always kind to all of her classmates and other students at [school]. Aria is sweet and soft spoken, always allowing others to go first. Aria is a joy to have in class."

Here is what Mr. Matthew had to say about Atalee!

"Atalee is a member of our safety patrol Part of her job is to get to know kids and connect with kids so that they feel a part of the school. There have been many times that I would see Atalee sitting on the floor with these younger kids and really connecting with them. She makes people feel good and is great at her job. She goes out of her way to make myself and others feel appreciated. Atalee’s grades are also very high. She mostly gets A’s on her report card. Although she is smart, she is never one to boast. She is possibly one of the most humble kids I know."

Here is what Mrs. Schepers had to say about Aubrielle!

"Aubrielle is an organized and mature student. She is well spoken and kind with her words. Aubrielle is friendly and includes others. She takes time to do her work correctly. Aubrielle can be counted on to follow rules and is helpful to a substitute. Aubrielle is a joy to have in class."

Here is what Mrs. Terry had to say about Austin!

"Austin is an overcomer. He is focused, determined and has been working very hard at making better decisions that put him on the path of success that he desires. In doing so, he has become more confident in himself. Austin has had the opportunity through a farm program that has enabled him to see potential and growth in working with others. It has been an honor to work with him and watch him to come and believe in himself."

Here is what Mrs. Myers had to say about Brinkley!

"Brinkley is the epitome of what a student should be. She makes it a point to go above and beyond with everything she does. This young lady is always willing to help others around her. She is very respectful to her teachers, as well as her classmates. In her daily walk, she strives for excellence. Brinkley always has a smile on her face and her positivity can radiate in a classroom. If there has ever been a student who qualifies for an "Absolutely Incredible Kid" award, it is Brinkley!"

Here is what Mrs. Ferguson had to say about Cheyenne!

"Cheyenne is a compassionate, kind-hearted, & strong-willed young lady that demonstrates strength and perseverance on a daily basis. She brings joy and laughter to everyone she meets. Even in tough situations, she rises above the challenges and strives to do her best. She always lends a helping hand and encourages everyone she meets. Her ability to bring smiles to others helps her create friends fast that love her for who she truly is. Her artistic nature shines through as she loves to make creations and share them with everyone. Everyday she comes in ready to take on the day with a positive attitude and an excitement and energy that is contagious and impossible to ignore."

Here is what Mr. Sorrell had to say about Dutch!

"He is absolutely incredible in so many ways! Dutch is bright, witty, and a very hard worker. Most importantly, though, Dutch is extremely kind. He always makes sure that everyone is included and is a good friend to everyone in the class. He is a leader and a willing helper at all times. Dutch is an absolutely incredible kid, and I am proud to nominate him for recognition!"

Here is what Mrs. Price had to say about Elise!

"Elise is an exceptional student, truly deserving of the Absolutely Incredible Kids Day award. Her cheerful personality, strong determination, and willingness to always help others make her stand out among her classmates. Elise goes out of her way to offer assistance to her classmates and teachers, whether it be filing paperwork or helping a student master a new standard. Her kindness and generosity shine brightly, reflecting God's light wherever she goes. She is a true inspiration to everyone around her and a wonderful example of what a leader should be."

Here is what Mrs. Schepers had to say about Joel!

"Joel arrives at school very cheerful each day. Joel is excited about learning and gives learning his all. He is always kind to his classmates. Joel has an innocent spirit and is very well behaved. Joel is a good example for others. Joel is a joy to have in class."

Here is what Mrs. Mendoza had to say about Joshua!

"He is making wonderful progress in first grade. He is kind and polite to his classmates. Joshua is an incredible kid with a heart for Jesus and would be the perfect student to receive this award."

Here is what Mrs. Schepers had to say about Kaia!

"Kaia is a kind and gentle friend to all. She has a sweet disposition and includes everyone in her play. Kaia always tries her best and takes her time to do her work neatly. Kaia can be counted on to do what is right. Kaia is a joy to have in class."

Here is what Mrs. Hames had to say about Kylie!

"Kylie is simply amazing! I have had the honor of having Kylie in class this year, and I am so grateful to know her! Kylie is a very respectful, hardworking, and kind student. She faces challenges with a quiet, determined spirit; I am frequently impressed by her resilience. Kylie sings beautifully in our school choir – to hear her is to be blessed and uplifted.

Teaching any student is a privilege, but it is especially precious when you have the opportunity to meet someone of Kylie’s caliber. The sky is the limit for this sweet young woman!"

Here is what Mrs. Goode had to say about Michael!

"I would like to nominate Michael for the ‘Absolutely Incredible Kids Day’ Celebration award because of his excellent work ethic, grit, and respect even if he may struggle with the content. He does not give up even if it would be easier to do so. He is a great communicator, a joy to have in class and a wonderful group member. He is helpful to his classmates and looks for solutions and possibilities instead of choosing to work less."

Here is what Mrs. Mosher had to say about Mila!

"Mila is an amazing student and leader. Her kindness and compassion is contagious. Mila has a positive outlook and can always offer a different perspective. She helps classmates and adults alike. Mila works hard at everything she does and is solutions focused. Her maturity lends to a second-to-none growth mindset. I know Mila will do amazing things and has already positively impacted our school and the world!"

Here is what Mrs. Stafford had to say about Olivia!

"Olivia is a child who is great at all she does. She does well in her academics, music, and all sorts of other things, but what makes her stand out is her ability to be a responsible student. She encourages others to also be responsible and she also knows how to have fun, all at the same time. She is a well-balanced young lady."

Here is what Mrs. Willcutt had to say about Sadie!

"Sadie goes above & beyond in her assignments. She helps students who need help with their work. She is a friend to all of her classmates. She is honest & hard-working!"

Here is what Mrs. Schepers had to say about Savannah!

"Savannah is a lover of people and animals. She is gentle and kind. She has a sweet voice with kind words. She always tries her best and puts forth her best efforts on her schoolwork. Savannah is a good example for others. Savannah is a joy to have in class."

We would like to take the time now to recognize each of the teachers who took the time to nominate a student! Thank you for recognizing the greatness in your students! Please know that we recognize greatness in teachers like you! With an already busy schedule, you found the importance of encouraging the students you get to see each day! The impact you have on the kids who cross your path may never be forgotten! Keep up the great work and know you are appreciated and supported by us at Collegedale Credit Union!

National Public Data Security Breach

CCU has been made aware of a National Public Data Security Breach that has stated that a number of personal records may have been compromised. We are posting this as a security precaution for you to be aware and to stay diligent with your account information.Here are some suggestions to protect your personal information and account(s):

- Update your antivirus protection and perform security scans on all devices. If malware is found most antivirus programs should be able to remove it, but you may need to seek reputable professional assistance in some cases.

- Update your passwords for bank accounts, email accounts, social media accounts, and other services used, ensuring your updated passwords are strong and unique for each account. Passwords should include uppercase and lowercase letters, numbers, and special characters whenever possible and should never include personal information that a hacker could guess or obtain from stolen data.

- The use of multifactor authentication is recommended on any accounts or services that offer it to ensure proper identity verification.

- Check your credit report and report any unauthorized use of credit cards. If you notice any suspicious activity, you can always ask credit bureaus to freeze their credit.

As always, if you have concerns or suspect you may have been a victim, please err on the side of caution and contact us immediately at 423-396-2101.

What is an Account Takeover (ATO)?

Account takeover is an attack in which cybercriminals take ownership of online accounts using stolen passwords and usernames. These cybercriminals then use these credentials to commit fraud. These bad actors purchase cardholders’ Personally Identifiable Information (PII) via the dark web—typically gained from social engineering, e.g., phishing, vishing, or smishing attacks (detailed below) or data breaches. Stolen PII (e.g., name, address, email, phone number, date of birth, business name, cellphone provider, social media and login accounts and passwords) provides the necessary credentials for a fraudster to pose as a cardholder.With this information fraudsters can engage with the cardholder’s financial organization and make changes to accounts or card settings to execute fraud. They may make demographic changes (e.g., phone numbers, emails, passcodes), or apply for increased limits, Personal Identification Number (PIN) changes and/or travel exemptions to suppress or interfere with our fraud-monitoring tools.

The activities described above are most commonly associated with merchant data breaches described in media reports. However, in the case of account takeover, the stolen data is not obtained from a payment system.

Skimming and Malware

Skimming and deployment of POS terminal malware continue to be widespread methods for stealing data. Smaller, local merchants are now more likely to be compromised than in years past. Stolen data, which is collected using POS malware, is passed to criminal networks through remote, wireless technologies with increasing speed. By reacting to fraud events quickly, your organization can significantly mitigate losses

Phishing

The prevalence of phishing (tricking cardholders into revealing confidential information) and its variants continue to rise. Phishing schemes are becoming more targeted (such as “spear-phishing”) and more difficult to identify than in the past. Instead of using only suspicious links in poorly designed emails, phishing emails are mimicking legitimate websites and appear more polished and credible. The use of web address shortening tools, such as TinyURL, make detection of suspicious links more difficult, even by savvy users. It is important to remind cardholders to safeguard their financial data and their online banking credentials against criminals trying to harvest it.

Vishing and Smishing

Smishing and Vishing schemes use sophisticated methods combined with social engineering to deceive cardholders into revealing critical information and disregarding legitimate fraud warnings. Smishing is the fraudulent practice of sending text messages claiming to be from reputable companies to induce individuals to reveal personal information, such as passwords or credit card numbers. Vishing is the fraudulent practice of making phone calls or leaving voice messages claiming to be from reputable companies to induce individuals to reveal personal information, such as bank details and credit card numbers. Cardholders may be sent a voice or text message with transaction details and requesting the cardholders confirm. When they respond, they may be questioned for account details, or they may be asked to call back a number to provide account information. In some instances, they are sent a one-time passcode (OTP). The caller or text message then instructs the cardholder to reply “No Fraud” to text/voice messages.

It is important to be on the lookout for these kinds of fraudulent messages that disguise themselves as legitimate fraud notifications. These schemes use sophisticated methods combined with social engineering to deceive cardholders into revealing critical information and disregarding legitimate fraud warnings. Additional red flags of note include hyperlinks and grammatical and punctuation mistakes.

Malicious Software

Malicious software, including software which compromises account-holder computers locally via Man-in-the-Browser (MitB) attacks are a significant threat to the security of financial data. Man-in-the-Browser attacks install malicious software in the background via “drive by download.” This malware is then able to monitor and hijack user web sessions to then transfer funds or harvest payment cards and online banking credentials, while redirecting the legitimate cardholder to a fictitious error page. This type of malware often deploys automatically when a user visits a compromised website.

Maintaining a secure, up-to-date operating system along with robust security and anti-malware software are critical first steps in preventing this type of fraud. Availability and deployment of automation and crime-ware is increasing in the card fraud world. Both all-in-one malware packages designed to compromise computer systems (e.g., Zeus, Citadel, Tilon) as well as individual tools able to crack passwords and to automatically carry out brute force attacks are available for purchase on underground websites and on criminal forums. Heavy reliance on one type of security tool or on older tools could lead to more fraud loss. We recommend a dynamic, multi-layered detection and prevention strategy.

Recommendations:

- Be aware of what information you are choosing to submit online and never easily provide your personal information.

- If you are concerned about an automated message, you should not respond to the call, text, or email. You should contact the company in question using the official customer service number on your own card or contact information listed on the company’s legitimate website. You should not contact any number provided by the fraud call or message and should not click on links in text messages.

- Always keep two-factor authentication codes private. Do not provide them via phone, text, or email. These codes should only be used to sign into the banking, merchant, or payment account when the consumer is trying to access it.

- Contact us at 423-396-2101 if you any questions or concerns regarding your account

Credit union deposits are safe

The collapse of Silicon Valley Bank is the second largest failure of a financial institution in U.S. history. The bank was shut down and put under the control of the FDIC following a 48-hour bank run and capital crisis. On March 12, regulators also shut down Signature Bank.While this situation does not include any credit union failure, it may still create consumer concerns and questions at credit unions. Collegedale Credit Union would like to take a moment to reassure our members about the safety and soundness of credit union deposits and remind you of the credit union difference as member-owned financial cooperative, and provide some peace of mind to you during this uncertainty.

- Collegedale Credit Union was chartered 70 years ago, and we are committed to serving our community. You can be assured that your money is safe and sound at our credit union. We have an experienced team to serve you and answer any questions or concerns.

- Credit union deposits in federally insured credit unions are safe and secure.

- Federally insured credit unions offer a safe place for credit union members to save money. These deposits are protected by the National Credit Union Share Insurance Fund and insured up to at least $250,000 per individual depositor – the same as any other federally insured financial institution.

- Credit union members have never lost a penny of insured savings at a federally insured credit union.

- You can visit MyCreditUnion.gov for more information about the National Credit Union Share Insurance Fund coverage for consumers.

In addition to our credit union-specific resources, you can find more information about the credit union difference on the Credit Union National Association’s Advancing Communities website at advancingcommunity.com.

Ways to Access Your Account

Drive-Thru – Our drive thru is open Mon-Wed: 8:00 am – 4:00 pm; Thurs: 8:00 am – 6:00 pm; Fri: 8:00 am – 2:00 pm.

Mobile Deposits – Deposit your checks from anywhere using your smartphone. Find out how to apply with one of our Member Services Representatives today!

Night Drop Box – Drop deposits, payments, and other correspondence off securely at the Night Drop located near the CCU Drive-Thru

Co-Op Shared Branching – gives you over 5,000 branches offering you more direct access to your money. Go to: https://collegedale.org/sharedbranch.htm

Co-Op Surcharge-Free ATM Network – gives you over 30,000 locations to make deposits and withdrawals wherever you are from coast to coast. Go to: https://collegedale.org/sharedbranch.htm

Main ATM – Make deposits and withdrawals at our ATM located just outside the CCU Office

Audio Response – Request a check withdrawal, get balances, a list of your transactions, tax and IRA information, and a sample payment calculator by calling our Audio Response Number at 1-800-427-6269

Mobile App – Access your account, bill pay options, and take charge of your debit card limits and restrictions by downloading our app located in your app store – "Collegedale CU Mobile Banking"

Virtual Branch – Call 423-396-2101 to sign up with Member Services

- Access your account and bill pay options

- Make ACH and Wire Transfer requests

- Line of Credit transfers

- Apply for a loan

- Update your contact information

Wires – The fastest way to send funds most anywhere without using cash, checks, or cards

Zelle® - A fast, safe, and free way to send money to friends and family

VISA Credit Card Info – Access your account at www.eZCardInfo.com or call 1-800-299-9842

MasterCard – E-mail contactus@creditcardservices.com, call 888-999-3304, or go to https://gonow.credit/collegedalecuapply to apply

GrooveCar – Find and finance your next vehicle by going to https://collegedale.groovecar.com/

Mail – Send deposits, inquiries, or requests to P.O. Box 2098 Collegedale, TN 37315

Website – You can find out how to become a member, open your account online, apply online for a loan, access our payment calculator, make an appointment with a loan officer and more by going to www.collegedale.org

Phishing Advisory

Early indications are showing that fraudsters may be increasing phishing attacks in an effort to exploit the current COVID-19 pandemic.Additionally, criminals in possession of card details and other forms of personally identifiable information are spoofing the phone number from financial institutions to fool cardholders into thinking that text messages and phone calls are actually from the fraud department of their financial institution.

Collegedale Credit Union would like to offer you the education you need to protect yourself with the following facts regarding CCU’s fraud department:

- CCU nor our fraud department will ever ask for your PIN, CV2 codes or Expiration Dates.

- A text alert warning of suspicious activity on a card will NEVER include:

- A link to be clicked.

- Requests for cardholder data such as card numbers, PINs, CV2 Codes, Expiration Date

- A text alert from us will always:

- Be from a 5-digit number, either 20733 or 37268

- Include detailed information about the transaction

- Ask the cardholder to reply to the text message with answers such as ‘yes’, ‘no’, ‘help’, or ‘stop’.

- A phone call from one of our Call Center agents will only include a request for the cardholder Zip code and a ‘yes’ or ‘no’ to the transactions they will provide

- No other personal information will be requested, unless the cardholder confirms that a transaction is fraudulent.

- If at any point, you are uncertain about questions being asked or a call you have received, please hang up and call CCU directly at 423-396-2101

TurboTax

You can now access TurboTax from our website.TurboTax:

- TurboTax calculations are 100% accurate, guaranteed

- Is a fast, easy and economical way to prepare and file tax returns

- Walks taxpayers step-by-step through their returns – no tax knowledge necessary

- Is updated with new tax law changes

- Supports more than 100 IRS tax forms, schedules and worksheets – and prepares all state returns, including the District of Columbia

- There’s no risk – you don’t pay until you are ready to print or electronically file your return

- TurboTax Federal Free Edition allows tax filers with simple federal returns to prepare, print, and file for FREE

Just a reminder; all tax forms for filing are mailed out by January 31 each year.

Same Day ACH is Here!

Did you know that your payments are now moving faster?

Thanks to Same Day ACH, payments that once took up to three days will now be complete in just hours.What Has Changed?

What this means for you is no more tied up funds, or watching your account wondering when a transaction will post. With the new system, “pending” ACH transaction time could be shortened to just a few hours—so you can always be clear on what you have available to spend.It is important to note that this also means the cushion of time between an ACH originating and processing will be gone, and you’ll want to carefully monitor your balances to ensure sufficient funds to cover transactions at all times.

What are ACH Transactions?

ACH stands for Automated Clearing House—it’s another way to move money paperlessly, and operates independently of credit and debit cards. Essentially, anytime you move money by providing your account number, and financial institution’s routing and transit number, you are probably making an ACH transaction.Some examples are:

- A payment that you make at a biller’s website that is deducted automatically from your checking account.

- A transfer that you initiate between your accounts at different financial institutions.

- Any transactions that require a voided check to initiate payment.

What Do I Need to Do?

The national ACH network will be updating to Same Day ACH on September 15.While the speed of Same Day ACH transactions will help you maintain a clearer picture of your finances, the change may take some getting used to. Collegedale Credit Union recommends getting in the habit of checking your balances daily.

For more information on the change to Same Day ACH, contact Collegedale Credit Union.

You Should Know...

Savings in every federally insured Credit Union are backed by the National Credit Union Share Insurance Fund (NCUSIF), a fund maintained by the U.S. Treasury. The NCUSIF is administered by the National Credit Union Administration, an agency of the federal government, which insures your savings up to at least $250,000. Federal insurance protects your money at your Credit Union in share savings, share draft/checking, money market, share certificate, trust fund and retirement accounts.Funds in a federally insured Credit Union can be insured to a level much higher than $250,000 depending on how you establish your accounts. For instance, jointly owned accounts and accounts with named beneficiaries are separately insured up to $250,000. For more information, ask a Member Service Representative.

—CUNA Inc. Copyright 2008

Virtual Branch Login

Virtual Branch Login